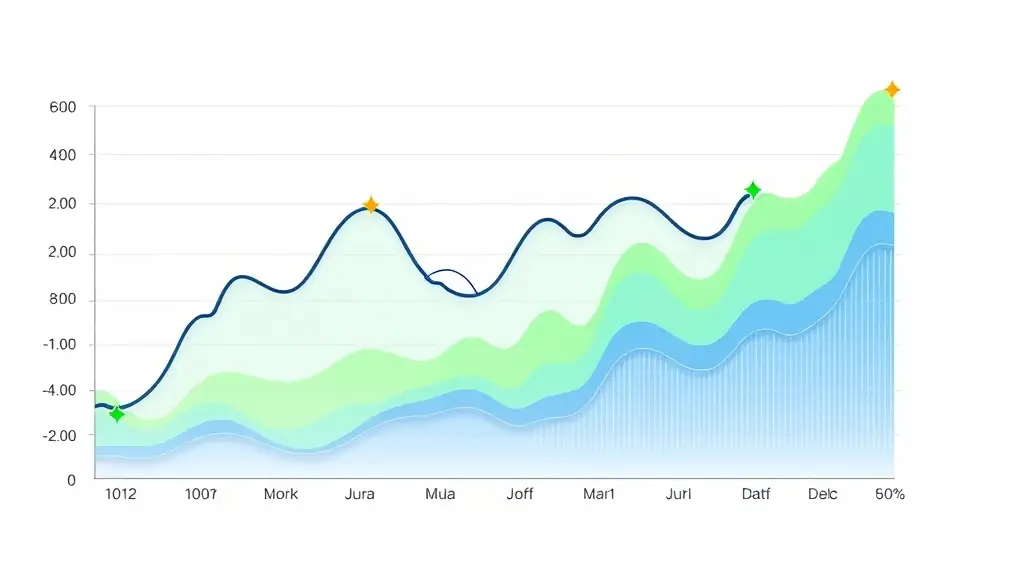

Cash flow is the lifeblood of any business, and optimizing it is essential for ensuring operational efficiency. Many business owners underestimate the impact of cash flow management, often leading to financial strain and missed opportunities. By focusing on cash flow optimization, businesses can improve their liquidity, allowing them to meet obligations and invest in growth initiatives. This process involves analyzing cash inflows and outflows to identify patterns and areas for improvement.

One effective strategy for cash flow optimization is to streamline invoicing and payment processes. By implementing clear payment terms and utilizing technology for invoicing, businesses can reduce the time it takes to receive payments. Additionally, maintaining a cash reserve can provide a buffer during lean periods, ensuring that the business can continue to operate smoothly. Regularly reviewing cash flow statements also helps in making informed decisions regarding expenditures and investments.

At Cornerstone Future Solutions, we offer comprehensive cash flow optimization services tailored to your business needs. Our approach includes detailed analysis and actionable recommendations to enhance your cash flow management. By partnering with us, you can gain valuable insights that will help you maintain financial stability and support your business’s growth trajectory.